You’re watching the wrong damn crisis.

Yeah, yeah, I know: For months now, the U.S. market has hopped and dipped almost daily because of the nonsense going on in Europe…

One moment, everyone is worried Germany will finally refuse to fund the PIIGS’ debt binge another minute, and the whole damn Union will unravel.

The euro plunges, forcing the dollar — and its hideous Chinese twin, the yuan — up. The great herd freaks, and suddenly U.S. stocks are sinking like a rock.

Next day, the sun comes up over Europe, and lo and behold, Paris, London, and Berlin are still standing and open for business. The euro rallies, the dollar drops, and by the time the U.S. market opens, stocks are a buy again.

Down 300 points one day, up 300 points the next. Talk about your pointless sturm und drang…

The Wrong Recession

I’m not saying the whole euro collapse thing isn’t happening.

Just this Monday, my compadré Chris DeHaemer alerted you the Germans are alleged to be printing up a secret supply of “Neumarks” just in case.

And I really don’t doubt that European GDP might be about to dip from “not really growing much at all” to plain old “shrinking a bit.” Heck, England’s master banker Mervyn King already conceded as much, right about the same time he announced a £75 billion liquidity injection.

What I’m saying is that the real “recession” problem is a lot further to the East.

Stay on top of the hottest investment ideas before they hit Wall Street. Sign up for the Wealth Daily newsletter below. You’ll also get our free report, Investing in the Vix: 3 VIX Funds to Own Now.

After getting your report, you’ll begin receiving the Wealth Daily e-Letter, delivered to your inbox daily.

The Right Recession

China GDP has been averaging 10.27% per annum over the past decade, impressive enough on its own, considering the West would give its eyeteeth for 1% growth these days…

China GDP has been averaging 10.27% per annum over the past decade, impressive enough on its own, considering the West would give its eyeteeth for 1% growth these days…

But this average papers over China’s rather alarming change in trend.

Back in 2007, China was a total rocket ship, growing at an amazing 14.2%. Even in the depths of the global crash that followed, they only dipped down to the mid 9s and 10s.

And thank the heavens for that, because China’s growth saved our collective Western behinds…

Just about every time some CEO was forced to trot out in front of an audience to explain how they could possibly survive the next ten minutes, their answer would always be: “Sales to China will save us all!”

That was Then, This is Now

Problem is, there is always a price to be paid for this sort of stuff. Back in the crash of 2000-2003, Uncle Sam did the dirty deed, fired up the big engine with an ungodly amount of imaginary money, and hauled the world’s caboose out of the hole.

Back in the crash of 2000-2003, Uncle Sam did the dirty deed, fired up the big engine with an ungodly amount of imaginary money, and hauled the world’s caboose out of the hole.

In the end, we suffered the inevitable bubbles and inflation — and finished off with one hell of a banking collapse.

Now, China is headed down that same road… and they don’t like it one little bit.

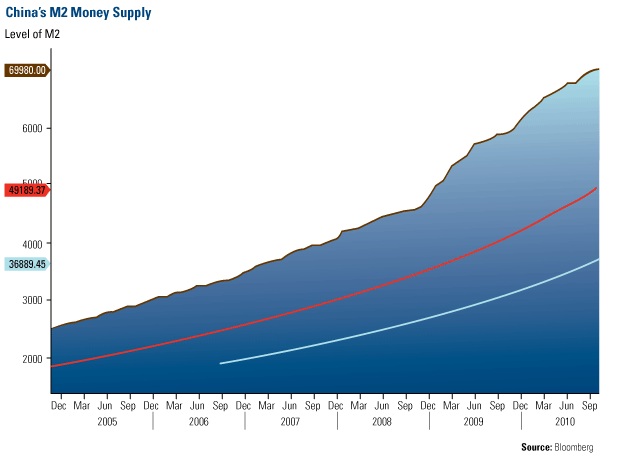

China’s 13.5% money supply growth has translated into a 6.2% year-over-year increase in their consumer price index.

Suddenly, China is trying to yank on the brake handle — and hard.

Chinese bank lending was slashed 87% between August and September, as per the commands of the central government.

Fiscal Sanity Hurts

This sudden discovery of “fiscal prudence” is creating a real uproar in the hinterland, where corrupt local governments have ginned up thousands of shell companies that circumvent Beijing’s attempts at central control.

Former deputy speaker of the People’s Congress, Cheng Siwei, complained at a meeting at the World Economic Forum in Dalian that interest rate rises and credit curbs to cool overheating were inflicting real pain on thousands of companies used by local party bosses to fund the construction boom:

The tightening policy is creating a lot of difficulties for local governments trying to repay debt, and is causing defaults. Our version of subprime in the US is lending to local authorities and the government is taking this very seriously.

Everybody assumes that they will be bailed out by the central government if they default, but I disagree with this. It means that the people will ultimately pay the bill for it all, at a cost to the broader welfare. Those who are not highly indebted are forced to help those who are.

Chanos Says, “Duck!”

Can the Chinese find that legendary beast, “a soft economic landing”?

When Kynikos Associate’s Jim Chanos (the guy who warned the world about those bastards at Enron), estimates China’s debt to GDP ratio at or around 200% and figures on total credit growth equal to 30%-40% of GDP in 2012.

China has conceded that 15%-20% of all new loans could go south. Chanos figures a 50% recovery rate on same, and concludes that Chinese GDP growth would take a 7.5%-10% hit on an after-write-off basis.

Take a second look at the Chinese GDP chart at the top of this article, and you’ll see that a drop like that would pull China down pretty damn close to the dreaded zero growth line.

This does not have the makings of a soft ANYTHING.

Rather, it looks to me like one hell of a train wreck for China’s engine — and all the rest of our sorry cabooses as well.

Three Ways to Play

There are three ways to play this wreck.

There are, of course, all those American companies that still desperately need Chinese sales to round out their profit reports. In Viral Investing, we have already gone after Caterpillar (NYSE: CAT).

CAT shares have been working their way lower since May and are currently at the top of the price channel, offering a cheap entrance into this long-term down trend.

And this week, I have isolated a particularly sweet victim: a major blue chip banker that could get cut in half when China goes off the rails…

To get complete articles and information, join our newsletter for FREE!

Plus receive our new free report, Predicting the VIX Moves

Good luck and good hunting,

Adam Lass

Editor, Wealth Daily